In this article, we provide a tactical guide on how to build a recession-proof business proactively to avoid having problems turn into crises.

What do we mean by a recession-proof business?

A recession-proof business is not a certainty, but rather an ideal to strive for. As NYU Business Professor Scott Galloway says, “Market dynamics trump individual performance.”

You may have the best team and still fail due to market-driven or economy-related forces. However, we believe that you can maximize for success by building a recession-proof strategy proactively - not just when things go sideways.

Uncertainty is constant but can be managed

With how uncertain running a company is in general, it is key to think not in absolutes, but rather in confidence levels. Instead of trying to completely de-risk a decision, aim to shift toward: we think this is the best way to move forward.

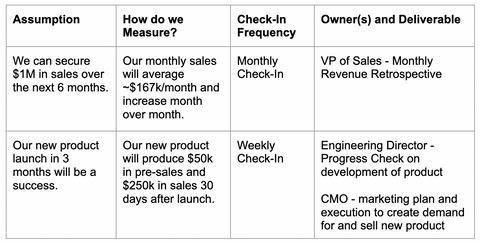

This does not mean that we ignore the risk that comes with uncertainty. We manage for it. In our article talking about Minimum Viable Products (MVPs), we covered the topic of risky assumptions. Risky assumptions are hypotheses that you think are true. By defining and strategizing around what we are uncertain about, we can manage those uncertainties.

As management leader Peter Drucker famously said, “what gets measured gets managed.”

Here are a few common risky assumptions:

- We have product-market fit.

- Our customers will never leave us.

- We will have a successful new product launch.

- We will generate $1M in revenue this calendar year.

Let’s dig deeper into the last assumption above. If your goal is to make $1M in sales over the course of 1 year, break that goal into shorter time segments. Doing this will allow you to check in more often and make sure your team is on track or needs to adapt.

What does managing uncertainty look like in practice?

Start by creating an Uncertainty Task Force to keep a pulse on specific uncertainties on a regular basis. The frequency of check-ins will depend on the uncertainty you are managing as well as external factors.

Quarterly is typically a good go-to. However, if you are in the midst of a recession, you may have these meetings weekly.

Here are some key points to keep in mind with these recurring meetings:

- Establish regular touchpoints with recurring meetings.

- It is important to have a clear owner taking full responsibility.

- Quantify as much as possible regarding what success looks like and what the timeline is.

- Tie this into a goal-setting framework such as OKRs or KPIs.

Make sure that your uncertainty management strategy is written down and organized. See an example of this in the table below:

Tactics to build a recession-proof organization

Know your numbers

All businesses operate in relation to their financials. Your financials allow you to launch new products, host events, grow your team, hire vendors, etc.

Business leaders sometimes lose track of their numbers. Keep a close eye on how much money you are spending per month vs. how much money you are bringing in.

It is good practice to keep a steady pulse on your numbers. If you have fallen out of habit, put together a Profit/Loss Statement for the previous 6-12 months. This will help you get a better idea of your organization’s financial health.

Build for succession

Keep your organization’s “house” in order.

Take a long-term view of your business and make sure that you are building it for your end-game throughout your journey. This may be building to sell one day or to pass on to the next generation of business leaders.

Here are some questions to ask when auditing if you are building for succession:

- Does your business have clear processes that are repeatable at scale?

- Do you have an operational handbook that runs through the key activities of your company?

- If you could no longer run your business tomorrow, would it still be able to operate?

- Are you investing in your team to upskill them to grow long-term with you?

- Is your product portfolio strong or in need of some work?

Assess your organization every quarter for risk factors

A story shares that if you put a frog in a pot of boiling water it will instantly leap out. But if you put it in a pot filled with tepid water and gradually heat it, the frog will remain in the water until it boils to death. Don’t be the frog.

Get in the habit of doing a pulse check on your organization at least once a quarter. Don’t wait until a recession to find all the problems your organization should have been dealing with all along.

The three key survival levers during a recession

Raise money

If you follow the same trajectory over the next 24 months, are you default dead or default alive?

In short, will your organization still be around under the same or worsening conditions?

If the answer is no and you are able to raise investment capital, consider this option. Giving away some additional equity is well worth it if it means that you can increase your chances of surviving a recession.

Keep in mind that during recessions, investors favor businesses that are profitable or have a clear and believable path to profitability.

Cut Costs

Start with your Profit/Loss Statement for the previous 6-12 months and look over every single line item. Ask yourself these questions:

- Where is my biggest source of spending coming from?

- What are my recurring expenses?

- How can I get creative about managing my expenses?

Everything is negotiable. Vendors are often very willing to work with you to keep your business over the long term.

Increase Revenue

Unless you are a pre-revenue startup, you should have sales history. Do a comprehensive audit of your sales strategy and review each tactic.

When reviewing your sales strategy, ask yourself:

- What is still working?

- What is leading to the highest ROI?

- Can I be more aggressive with winning sales tactics now in order to increase revenue in the short term (and hopefully across the long term)?

Plan for uncertainty using scenario planning

Scenario planning is making assumptions about what the future is going to be and how your business will need to adapt. Bucket these assumptions into different scenarios such as Best, Middle, and Worst.

For example, farmers use scenario planning to predict whether their harvest will be good or bad depending on the factors such as weather. Scenario planning allows them to forecast their sales and adjust future investments.

Let's go back to our risky assumption example earlier: generating $1M in sales in the upcoming calendar year. Map out what different scenarios may look like and how you will adapt. Branch out to specific outcomes and draft your response if it were to occur. The more detail the better.

If your sales were much lower than you forecasted, what is your course of action? What if sales were good, but not great? What if your team is struggling to keep up with the demand of excited leads wanting to buy?

Lead with the heart when making tough decisions

Be honest and communicate with your team often

One of the worst things that you can do as a leader is turn away from your team and keep them in the dark. Bad news travels fast.

Use this template to share updates with your team:

This is the problem. Here is what we are doing to address It. Here is what you need to know now. This is when we will have the next update.

Would you rather be the leader who was honest with your team and worked hard to find collaborative success? Or the leader that put the burden entirely on themselves and blindsided their team when it did not work out?

Layoffs should be the last thing you consider

You have spent a lot of time, energy, and money building your world-class team. Your top priority should be retaining them.

Cut costs wherever else possible. Other levers to consider before layoffs:

- Salary freezes.

- Pause hiring new team members.

- Offer a trade to employees where they trade in salary for equity.

If you do need to lay people off:

- Give them as much notice as possible.

- Support them after by providing recommendations, endorsements, and introductions.

- Read The Mochary Method’s Approach to Firing Well.

Above all, be human. Be compassionate.

Frequently Asked Questions

Is this recession-proof business guide comprehensive?

No. No guide is nor should claim to be. Every recession will be different and vary by industry. Think of this guide as a playbook to personalize and put into action across your business.

We recommend identifying peers who are running similar, but not competitive businesses. Meet with them quarterly to share problems, resources, and asks. This will help highlight blind spots in your business operations, keep you accountable, and ground you with a supportive peer group.

Where can I learn more about how real business owners led through recessions?

In 2020, we did a webinar series called Crisis Response that highlighted business leaders who led businesses through down economies. You can find our conversation with software entrepreneur, Greg Coticchia, linked here. You can find our conversation with hardware entrepreneurs, Afshan Khan and Ilana Diamond, linked here.

Looking for a recession strategy session?

Looking for a coach to help you build your recession strategy? Fill out The CEO Strategy’s Contact Form to request a coach. We will match you with someone from our team who will guide you through the process.

What do business leaders think of the recession strategy session?

Here is a testimonial from Kevin Carter who is the Head of Business Development at EcoMap Technologies:

"Our team had just raised its $3.5M Seed Round and we knew tough economic conditions were not too far away so we did The CEO Strategy's Recession Strategy Workshop in June 2022. Our coach, Max, walked us through strategies around identifying and managing uncertainty which helped to guide some of our most important management decisions in the back half of 2022. Max even made a strategic introduction which turned into a customer for us later that year. I cannot recommend Max and the strategy workshop with The CEO Strategy highly enough."